Last Updated on September 25, 2024 by Vlad

Wang Chuanfu’s journey from the son of poor farmers to one of the world’s wealthiest individuals is an inspiring tale. Growing up under harsh conditions, Wang displayed perseverance and a strong interest in science, which eventually led him to found BYD Company Limited. His relentless drive and innovative vision led BYD to become the world’s largest EV company by sales, overtaking industry giant Tesla in 2022.

“Wang’s vision and commitment to sustainability have revolutionised the EV industry,” said an industry expert. “His leadership has set a new standard for innovation.”

Table of Contents

Wang’s strategic decisions, such as focusing on electric vehicles and renewable energy technologies, were pivotal in BYD’s success. This growth attracted significant investments, including from Warren Buffett’s Berkshire Hathaway. By diversifying the company’s portfolio and forming strategic partnerships, Wang ensured BYD’s robust market presence and impressive financial growth.

Wang Chuanfu’s success is not just marked by his wealth, but also by the impact of his business ventures in promoting sustainable technologies. As of July 2024, Wang’s net worth was valued at $19.6 billion, reflecting his influential role in transforming the electric vehicle market and contributing to a greener future.

Key Takeaways

- Wang Chuanfu grew up under harsh conditions with a strong interest in science.

- BYD became the world’s largest EV company by sales in 2022.

- Wang’s net worth reached $19.9 billion as of March 2023.

Early Life and Education of Wang Chuanfu

Wang Chuanfu was born in Wuwei County, Anhui province, China, to a family of poor farmers. His early life was marked by significant hardship. When he was young, both of his parents passed away, making him an orphan. He was subsequently raised by his elder brother and sister.

Despite these challenges, Wang excelled in his studies. In high school, his determination and dedication were evident. Wang later attended the Beijing Non-Ferrous Research Institute, where he pursued a degree in chemistry. This choice laid a strong foundation for his future career in technology and business. Afterward, he earned a master’s degree in materials science. This higher education was key to his later success, providing him with the expertise needed to innovate in the field of electric vehicles (EVs).

His early struggles and strong educational background played a significant role in shaping his journey from a peasant’s son to a prominent business figure. This combination of personal resilience and academic excellence set the stage for his future achievements. Today, he is known as the founder of BYD, a leading electric vehicle company.

Founding of BYD Company Limited

BYD Company Limited was established by Wang Chuanfu, who transitioned the firm from initially focusing on batteries to becoming a leader in electric vehicles. Key investments, including that of Warren Buffett, significantly boosted the company’s growth and reputation.

Transition from Batteries to Automobiles

Wang Chuanfu founded BYD Company Limited in 1995 with a focus on manufacturing rechargeable batteries for mobile phones and other electronic devices. By the turn of the century, BYD had become the world’s largest manufacturer of mobile phone batteries. This success laid a solid financial and technological foundation for the company. In 2003, BYD made a strategic decision to enter the automobile industry, using its expertise in battery technology to produce electric vehicles (EVs). This move proved to be pivotal as the demand for EVs began to surge.

Investment by Warren Buffett

In 2008, Warren Buffett’s Berkshire Hathaway invested $230 million in BYD. This investment was not just financial but also a significant endorsement of BYD’s potential and credibility. Buffett acquired a 10% stake in the company through his investment vehicle. This financial backing allowed BYD to expand its research and development, leading to innovative advancements in EV technology and enabling the company to scale its production and enter new markets more effectively.

Quote: “Investing in BYD was a bet on the future of clean energy and the brilliant leadership of Wang Chuanfu,” said Warren Buffett.

Expansion and Diversification

Wang Chuanfu expanded BYD Group’s business by entering the solar energy sector and innovating in electric vehicle technology. This strategic shift not only diversified the company’s revenue streams but also positioned it as a leader in sustainable technologies.

Entry into the Solar Energy Sector

By entering the solar energy sector, Wang demonstrated foresight in anticipating the growing demand for renewable energy. BYD began producing solar panels and energy storage systems. These products helped reduce carbon footprints, aligning with global sustainability goals. The company also integrated solar panels with their electric vehicles, creating seamless energy solutions. This strategic move to diversify and future-proof BYD’s business operations illustrated Wang’s vision and leadership.

Innovation in Electric Vehicle Technology

Wang led BYD to significant advancements in electric vehicle technology. The company developed long-lasting batteries and efficient electric drivetrains. These innovations helped BYD vehicles stand out in the competitive EV market. The introduction of models like the BYD Tang and Qin further established their dominance. Production scaled up to meet rising global demand, with BYD focusing on innovation, safety, and affordability. Wang’s commitment to innovation drove the company to overtake competitors and become a leading player in the EV market.

Wang Chuanfu’s Business Philosophy

Wang Chuanfu has built his success through a unique approach to business. Key aspects include a strong emphasis on research and development and a commitment to sustainable business practices.

Emphasis on Research and Development

Wang believes heavily in the power of innovation. He has positioned BYD as a leader in electric vehicle technology by investing significantly in research and development. BYD allocates a substantial portion of its revenue to R&D each year, surpassing many of its competitors. This commitment allows the company to stay ahead in the rapidly evolving EV market. By nurturing a culture of continuous improvement, Wang encourages his teams to explore new technologies and improve existing ones, leading to breakthroughs in battery technology and energy storage solutions.

Case Study: BYD’s Breakthrough in Battery Technology and the Success of the BYD Tang

BYD (Build Your Dreams) has established itself as a leader in the electric vehicle (EV) industry, largely due to its innovative advancements in battery technology. One of the most significant breakthroughs in BYD’s history is the development of its Blade Battery, a revolutionary technology that has set new standards for safety and efficiency in the EV market. This case study explores the impact of the Blade Battery and the success of the BYD Tang, a popular EV model that showcases the company’s technological prowess.

Blade Battery: A Game Changer

In March 2020, BYD introduced the Blade Battery, a new type of lithium iron phosphate (LFP) battery. The Blade Battery is designed to address two major concerns in the EV industry: safety and energy density.

- Safety: The Blade Battery is known for its superior safety performance. Traditional lithium-ion batteries can experience thermal runaway, leading to fires or explosions. The Blade Battery, however, undergoes rigorous safety testing and has proven to be highly resistant to such incidents. It can withstand extreme conditions, such as nail penetration, crushing, and high temperatures, without catching fire or exploding.

- Energy Density: Despite its safety features, the Blade Battery does not compromise on energy density. It offers a competitive range and performance, making it suitable for a wide range of EV applications. The innovative design allows for more efficient use of space, leading to a higher energy density compared to traditional LFP batteries.

Impact on the Market

The introduction of the Blade Battery has had a profound impact on the EV market. It has set new benchmarks for safety and reliability, making BYD’s EVs more attractive to consumers and investors alike. The Blade Battery’s success has also prompted other manufacturers to explore similar technologies, further advancing the entire industry.

The BYD Tang: A Success Story

The BYD Tang is one of the flagship models that features the Blade Battery. Launched in 2015, the BYD Tang has become a symbol of BYD’s innovative capabilities and commitment to quality. The vehicle combines impressive performance, safety, and affordability, making it a popular choice among consumers.

- Performance: The BYD Tang offers robust performance with a powerful electric motor and a substantial driving range. The incorporation of the Blade Battery enhances its efficiency and reliability, providing a seamless driving experience.

- Safety: Equipped with the Blade Battery, the BYD Tang ensures top-notch safety for its occupants. The vehicle has undergone extensive testing and meets stringent safety standards, offering peace of mind to drivers and passengers.

- Affordability: Despite its advanced features, the BYD Tang is competitively priced, making it accessible to a broad consumer base. This balance of quality and affordability has contributed to its widespread adoption.

Sustainable Business Practices

Wang’s vision extends beyond just making profits; sustainability is at the core of BYD’s operations. Under his leadership, BYD aims to reduce the carbon footprint of its production processes and products. The company has implemented eco-friendly manufacturing practices to minimise waste and energy consumption. Sustainability is also reflected in the range of products BYD offers, from electric buses to solar panels. These products contribute to the global shift towards renewable energy and emission reduction. Wang’s holistic approach ensures that sustainability is integrated into every aspect of the business.

Public Offerings and Valuation Milestones

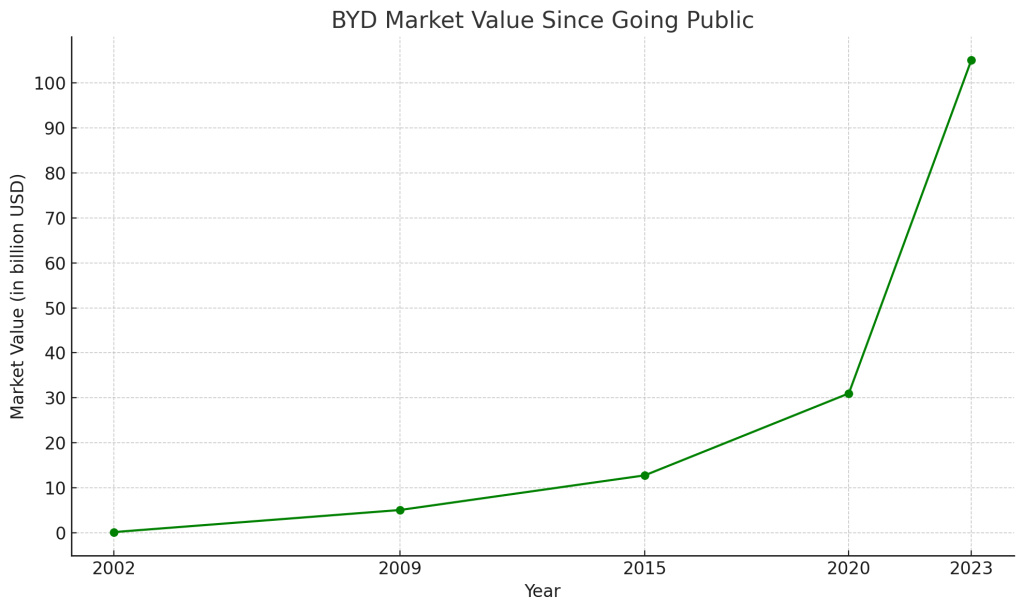

Wang’s wealth is closely tied to BYD’s impressive public offerings and significant valuation milestones. These events have played a crucial role in establishing the company’s market presence and solidifying its financial strength.

Initial Public Offering of BYD

BYD first went public on the Hong Kong Stock Exchange in July 2002, raising approximately USD 200 million. This IPO helped BYD fund its early expansion into the rechargeable battery and electric vehicle markets. The company further solidified its market position with a secondary listing on the Shenzhen Stock Exchange in 2011. This dual listing strategy attracted a wide range of investors, enhancing liquidity and improving the stock’s performance.

Growth and Market Capitalisation

Since its IPO, BYD’s market capitalisation has seen substantial growth. By the end of 2009, BYD had gained a valuation of USD 5.1 billion, making Wang Chuanfu the richest person in China at that time. The company’s financial performance continued to improve, leading to further increases in its valuation. In 2022, BYD became the world’s largest electric vehicle company by sales, overtaking Tesla. At that time, BYD accounted for 21% of the global electric vehicle market. The company’s net profit more than doubled to RMB 21.37 billion in the first nine months of 2023, and the share price soared more than fivefold, reflecting its robust financial health and market position.

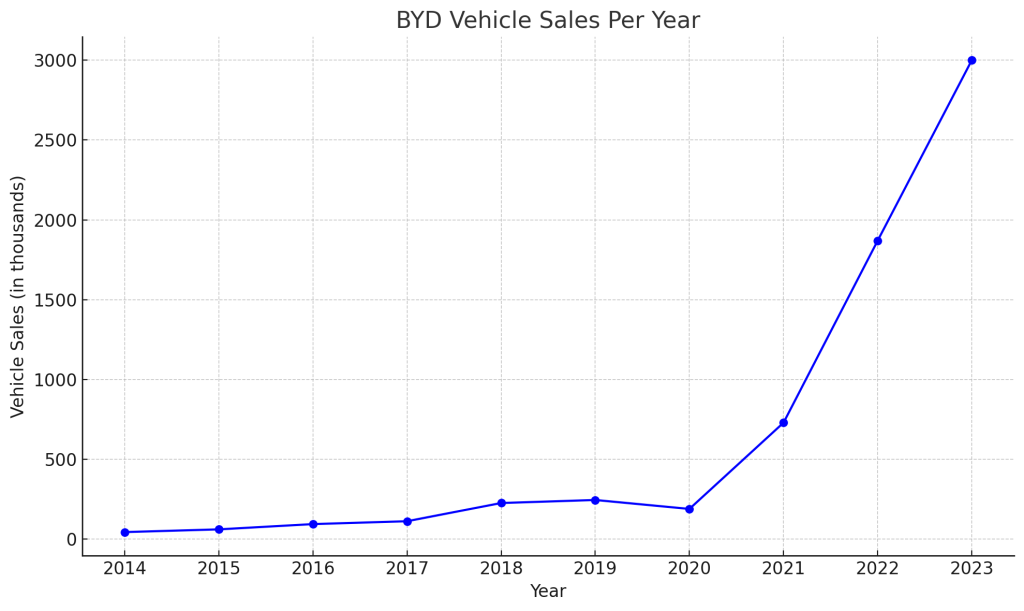

Vehicle Sales Growth

The growth in vehicle sales is a key indicator of BYD’s success and market dominance. Over the past decade, BYD has experienced substantial increases in vehicle sales, reflecting the company’s strategic expansion and innovation in electric vehicle technology.

The following graph illustrates BYD’s vehicle sales per year from 2014 to 2023, showing significant growth, especially in recent years:

As shown in the graph, BYD’s vehicle sales grew from 45,000 units in 2014 to an impressive 3,000,000 units in 2023. This exponential growth highlights the company’s ability to scale production and meet the rising global demand for electric vehicles. Key factors contributing to this growth include advancements in battery technology, the introduction of popular EV models like the BYD Tang and Qin, and strategic investments in research and development.

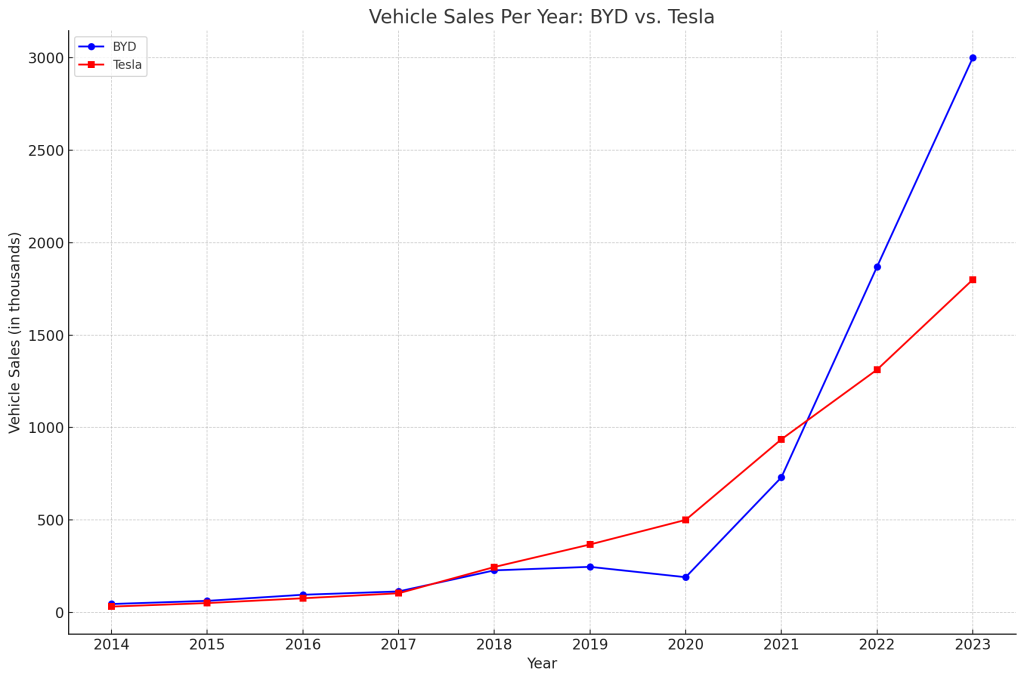

For a comprehensive comparison, the graph below compares the vehicle sales of BYD and Tesla over the same period, highlighting BYD’s recent surge in sales:

The comparison with Tesla, the other major player in the electric vehicle market, provides additional context to BYD’s achievements and sky-high growth. While Tesla experienced steady growth, reaching 1,800,000 vehicle sales in 2023, BYD’s sales have surged dramatically, particularly in the last few years. This rapid increase can be attributed to BYD’s aggressive market strategies, diverse product offerings, and strong support from the Chinese government, which promotes electric vehicle adoption.

BYD’s ability to outpace Tesla in vehicle sales underscores its competitive edge in the EV market. The company’s focus on affordability, safety, and innovation has resonated with consumers, leading to a dominant market position. The strategic partnerships and acquisitions, such as the collaboration with Toyota and the acquisition of Qinchuan Auto, have further strengthened BYD’s capabilities and market reach.

Acquisitions and Strategic Partnerships

One of the key drivers behind Wang Chuanfu’s wealth has been his strategic use of acquisitions and partnerships. BYD, under Wang’s leadership, has strategically acquired and partnered with several companies to enhance its technological capabilities and market reach.

Key Acquisitions and Partnerships

- 2007: Qinchuan Auto – Acquired to gain essential car-making expertise.

- 2019: Huawei – Partnership to develop intelligent car hardware and software.

- 2020: Toyota – Joint venture to develop electric vehicles, combining BYD’s battery technology with Toyota’s vehicle knowledge.

These moves have positioned BYD strongly in the global EV market, reflecting Wang’s strategic thinking in acquiring skills and knowledge that enhance BYD’s capabilities and competitive edge.

Challenges and Controversies

Wang Chuanfu has faced several challenges on his path to success. Some workers and critics point out that BYD used a large workforce on short-term contracts to keep costs low, raising concerns about worker rights. BYD has also faced fierce competition from American and European companies, as well as domestic Chinese brands, creating strategic and production challenges. Environmental groups have criticised BYD’s manufacturing processes for their environmental impact, raising questions about the company’s commitment to sustainable practices. Additionally, increased regulatory scrutiny has affected its operations and strategies. Despite these challenges, Wang Chuanfu has maintained BYD’s position as a leading EV maker.

Key Challenges

- Labour Practices – Use of short-term contracts to avoid wage increases, raising concerns about worker rights.

- Market Competition – Fierce competition with US and European companies.

- Environmental Impact – Criticism for the environmental impact of manufacturing processes.

- Regulatory Pressures – Increased scrutiny and regulations impacting operations.

Wang Chuanfu’s Net Worth and Philanthropy

As of July 2024, Wang Chuanfu has a net worth of $19.6 billion, ranking #98 in the world according to Forbes. He is the largest shareholder of BYD, which accounts for the bulk of his wealth. His company’s revenue reached 424 billion yuan ($63.1 billion), highlighting his significant role in the EV market.

Despite his wealth, information on his philanthropic efforts is scarce. While Wang’s primary focus has been on expanding his business and technological innovations in electric vehicles, details on his charitable contributions or philanthropic activities are not widely available. However, given his significant influence and resources, it is likely that his future endeavours may include expanded efforts in philanthropy.

Future Prospects of BYD

BYD is set to maintain its position as a leading electric vehicle manufacturer. The company has consistently increased its market share, challenging established giants like Tesla. One major area of growth is the global push towards electric transportation, with countries setting stricter emissions regulations, boosting demand for EVs.

Expansion Plans

- New Markets – Expanding into Europe and North America.

- Product Line – Developing new models and technologies.

Innovation and Technology

- Investing heavily in battery technology to enhance efficiency and range.

- Focusing on autonomous driving capabilities and connectivity features.

Partnerships

- Collaborations with technology firms and other car manufacturers.

- Utilising partnerships to enter new markets and develop advanced technologies.

BYD also benefits from strong government support in China, which offers incentives for both manufacturers and consumers of electric vehicles. Strong leadership remains a key asset for BYD, with Wang Chuanfu driving innovation and expansion efforts. His vision positions BYD well to capitalise on the increasing demand for EVs. BYD’s diverse product range, from buses to passenger cars, allows it to cater to various market segments effectively, enhancing the company’s resilience and potential for growth.

What Can We Learn from Wang Chuanfu?

Wang Chuanfu’s journey from a humble background to becoming a billionaire and a leader in the electric vehicle industry offers several valuable lessons:

Perseverance and Resilience

Wang’s early life was filled with hardship, losing his parents at a young age and being raised by his siblings. Despite these challenges, he remained focused on his education and future. His story teaches us the importance of perseverance and resilience in the face of adversity. No matter the obstacles, Wang’s determination to succeed never wavered, showcasing the power of persistence.

Innovation and Vision

Wang’s decision to shift BYD from a battery manufacturer to a leader in electric vehicles was a bold and visionary move. He saw the potential of EVs long before they became mainstream. This foresight and willingness to innovate have been critical to BYD’s success. Wang’s story emphasises the importance of having a clear vision and being open to innovation, even when it involves taking significant risks.

Strategic Thinking

Throughout his career, Wang has made strategic decisions that have propelled BYD to the forefront of the EV market. From focusing on R&D to forming key partnerships and entering new markets, Wang’s strategic thinking has been a cornerstone of BYD’s growth. This highlights the value of strategic planning and the ability to adapt to changing market dynamics.

Commitment to Sustainability

Chuanfu’s commitment to sustainable practices and renewable energy is a defining aspect of his leadership. By prioritising eco-friendly technologies and reducing carbon footprints, Wang has positioned BYD as a leader in sustainable innovation. This teaches us the importance of aligning business success with environmental responsibility and the long-term benefits of sustainable practices.

Investment in Research and Development

Wang’s emphasis on R&D has allowed BYD to stay ahead in the competitive EV market. By investing heavily in innovation, the company has developed cutting-edge technologies that differentiate it from competitors. This underscores the importance of continuous improvement and investment in knowledge and technology to drive business success.

Leadership and Visionary Management

Wang’s hands-on management style and visionary leadership have been pivotal in guiding BYD’s growth. His ability to foresee market trends and his commitment to the company’s mission have inspired his team and driven the company’s achievements. This illustrates the impact of strong, visionary leadership on an organisation’s success.

Adaptability and Learning

Wang’s ability to adapt to new challenges and learn from different industries has been crucial. His background in chemistry and materials science laid the foundation for his success in battery and EV technology. Wang’s story highlights the importance of being adaptable and continuously learning to stay relevant and innovative.

Frequently Asked Questions on Wang Chuanfu’s Rise to Riches

What are the main sources of Wang Chuanfu’s wealth?

Wang Chuanfu’s wealth primarily comes from his stake in BYD, which has grown to be one of the largest EV manufacturers globally, surpassing Tesla in sales in 2022.

How has Wang Chuanfu’s career in the automotive industry influenced his financial success?

Wang’s innovative approach to EVs has set BYD apart from competitors. His focus on battery technology and sustainable energy solutions has been pivotal in achieving financial growth.

What role did Wang Chuanfu’s education play in his rise to wealth?

Wang studied Chemistry at Central South University, followed by a Master’s in Metallurgy at the Beijing General Research Institute for Nonferrous Metals. His educational background in science and technology laid the foundation for his innovations in battery and EV technologies.

What leadership qualities of Wang Chuanfu have been pivotal to his company’s growth and his personal wealth accumulation?

Wang is known for his visionary leadership and hands-on management style. His ability to foresee market trends and his commitment to innovation have been crucial in driving BYD’s success and his personal wealth.