Last Updated on August 7, 2024 by Vlad

Leon Black, an influential figure in the financial world, has built an impressive fortune over the years. His journey to billionaire status began with his early career at Drexel Burnham Lambert, where he was a prominent figure in the high-yield bond market. His major breakthrough came with the founding of Apollo Global Management in 1990, a firm that has grown into one of the largest private equity firms globally.

Black’s investment strategy and philosophy have played a crucial role in his success. Apollo Global Management is known for acquiring distressed companies and turning them around, leading to significant profits. His keen eye for profitable deals and investments has also bolstered Apollo’s and his own wealth.

Throughout his career, Leon Black has faced challenges and controversies, but his influence on the financial industry remains undeniable. People wonder, how did Leon Black get rich? His success is largely attributed to his financial acumen, strategic investments, and the founding of Apollo Global Management. Additionally, his philanthropy and extensive art collection highlight his multifaceted success and interests..

Key Takeaways

- Leon Black founded Apollo Global Management, key to his wealth.

- Investment strategy focused on distressed assets and turnarounds.

- Significant influence in finance, balanced with philanthropy and art.

Early Life and Education

Leon Black was born in 1951. His father, Eli M. Black, was a successful Jewish businessman who emigrated from Poland. His surname was initially “Blachowitz.” Eli later became the chairman and majority owner of the United Brands Company. Leon’s mother, Shirley Lubell, was an artist and the sister of Tulsa oil executive Benedict I. Lubell.

Growing up, Leon experienced both privilege and tragedy. In 1975, his father tragically committed suicide. Despite this, he pursued higher education vigorously.

Leon attended Dartmouth College for his undergraduate studies. After Dartmouth, he went on to Harvard Business School, graduating in 1975. This education provided a solid foundation for his future career in finance and investment.

Leon inherited $75,000 in life insurance money after his father’s death. This inheritance played a role in his early ventures into trading and finance, setting the stage for his eventual success.

Key Points:

- Born: 1951

- Father: Eli M. Black, businessman

- Mother: Shirley Lubell, artist

- Undergraduate: Dartmouth College

- Graduate: Harvard Business School (Class of 1975)

- Inheritance: $75,000 in life insurance

Rise at Drexel Burnham Lambert

Leon Black began his career at Drexel Burnham Lambert in the late 1970s, working alongside Michael Milken, the “Junk Bond King.” At Drexel, Black quickly rose through the ranks due to his expertise in mergers and acquisitions (M&A).

Notable Successes:

- High-Profile Deals: Black was involved in several high-profile corporate takeovers that cemented Drexel’s dominance in the junk bond market. His ability to navigate complex financial landscapes made him a key player at the firm.

- Innovation: He contributed to innovative financial strategies, such as leveraging high-yield bonds, which helped companies raise capital for expansion and acquisitions. These strategies played a crucial role in establishing Drexel as a powerhouse on Wall Street.

Achievements at Drexel:

- Helped Drexel dominate the junk bond market.

- Played a key role in high-profile corporate takeovers.

- Contributed to making Drexel executives wealthy.

Challenges Faced:

- Intense regulatory scrutiny.

- High-yield bonds were risky and controversial.

Despite Drexel’s eventual collapse in 1990 due to scandals and legal troubles, Leon Black’s tenure there was instrumental in establishing his reputation in the finance world.

For more detailed information, visit Renegades of Junk: The Rise and Fall of the Drexel Empire.

Apollo Global Management Founding

Apollo Global Management was founded in 1990 by Leon Black, Marc Rowan, and Josh Harris. Their mission was to build a leading firm in private equity.

Starting Apollo was a strategic move, focusing on buying undervalued or distressed companies. This strategy helped Apollo grow quickly.

Apollo Key Points:

- Founded: 1990

- Founders: Leon Black, Marc Rowan, Josh Harris

- Focus: Private equity, buying undervalued/distressed assets

Apollo quickly grew into a significant player, managing billions of dollars across various sectors. With Leon Black’s leadership, Apollo established itself as a giant in private equity, known for generating high returns for its investors.

Expansion and Success of Apollo

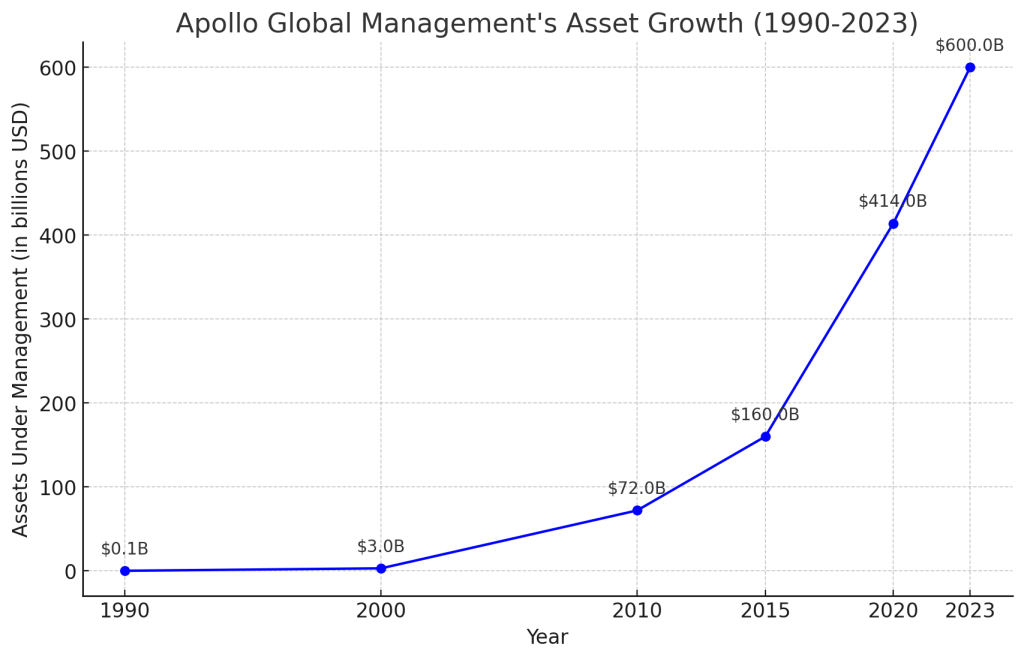

Leon Black co-founded Apollo Global Management in 1990, which quickly became a major player in private equity. By 2023, Apollo managed $600 billion in assets, specialising in leveraged buyouts, distressed assets, and corporate restructuring.

Apollo’s Strategy:

- Identifying undervalued companies.

- Implementing operational improvements.

- Diversifying investments.

In 2021, Black stepped down as CEO, paving the way for new leadership. During his tenure, Apollo maintained a strong position through strategic decisions and governance changes.

Apollo continues to grow and diversify its portfolio, ensuring its place as a leader in the financial sector. The company’s approach focuses on sustainable growth and innovation, leveraging their extensive industry knowledge and resources.

Major Deals and Investments

LyondellBasell Turnaround

Leon Black led Apollo’s acquisition of LyondellBasell out of bankruptcy. This move not only saved the company but also transformed it into a profitable venture. The deal demonstrated Apollo’s strength in restructuring distressed assets.

Impact on Apollo’s Portfolio

- Financial Growth: The successful turnaround of LyondellBasell significantly boosted Apollo’s portfolio, showcasing the firm’s capability to manage and revive struggling companies. This deal alone generated substantial returns for Apollo’s investors.

- Market Influence: This deal solidified Apollo’s reputation as a leader in the private equity industry, attracting more investors and high-profile deals. The success of LyondellBasell was a testament to Apollo’s strategic vision and operational expertise.

Another major investment was in Caesars Entertainment. Apollo invested in the struggling casino operator, managing to navigate the complex business landscape and create value for shareholders.

Important Deals and Investments:

- LyondellBasell: Acquired out of bankruptcy, later went public with tremendous returns.

- Caesars Entertainment: Invested in and revitalised a struggling casino operator.

- Verso Paper: Acquired and restructured, resulting in profit when sold.

In 2013, Apollo bought McGraw-Hill Education for $2.4 billion, aiming to shift its focus towards digital learning.

Investment Focus:

- Digital Learning Shift: The investment in McGraw-Hill adapted traditional businesses to newer trends.

- Distressed Assets: Turning around companies like LyondellBasell showcased the ability to extract value from challenging situations.

Another major deal was the purchase of Claire’s Stores. Black’s strategy involved navigating the retail sector’s ups and downs, ultimately yielding profitable results for Apollo.

Through these ventures, Leon Black demonstrated his ability to leverage distressed assets and shifting business dynamics for financial gain.

Investment Strategy and Philosophy

Leon Black’s investment strategy focuses on identifying underpriced assets and unlocking their value. He believes in buying distressed companies, restructuring them, and selling them for a profit. This approach has been central to his success at Apollo Global Management.

Key Elements of His Strategy:

- Distressed Assets: Targets companies in financial trouble, offering high returns once turned around.

- Restructuring: Involves cutting costs, debt reduction, and strategic changes.

- Long-term Perspective: Often holds assets longer to realise their full value.

- Diverse Portfolio: Spreads risk by investing in various sectors.

Philosophical Approach:

- High-Risk, High-Reward: Takes risks if the rewards justify it.

- Emphasis on People: Values working with intelligent and driven individuals.

- Analytical Rigor: Decisions backed by thorough analysis and data.

Example Investments:

- Noranda Aluminium: Acquired during financial difficulties and revitalised.

- LyondellBasell: Rescued from bankruptcy and successfully turned around.

Black’s philosophy of seeking high-potential, undervalued assets and transforming them sets him apart in the investment world.

Personal Life and Impact

Leon Black’s personal life and interests have significantly influenced his career and philanthropic efforts. He is married to Debra Black, and they have several children. His family background and personal experiences have shaped his approach to business and charity.

Personal Interests:

- Art Collection: Black’s extensive art collection, including the famous “The Scream” by Edvard Munch, reflects his passion for art and culture. His collection is valued at around $1 billion and includes works by other renowned artists.

- Philanthropy: Together with his wife, Black leads the Leon Black Family Foundation, focusing on arts, culture, and education. They have supported various New York City art institutions and have made significant donations to museums and cultural projects.

Key Highlights:

- Foundation: Leon Black Family Foundation

- Focus: Arts and cultural institutions

- Significant Purchase: Edvard Munch’s “The Scream”

Through significant donations and strategic purchases, Black plays a prominent role in supporting and preserving the arts. More details about his art deals and philanthropy reveal his tactical approach to managing his wealth and influence in these fields.

Wealth Accumulation and Assets

Leon Black’s primary source of wealth comes from Apollo Global Management. His extensive stake in the firm has significantly contributed to his vast fortune. He currently owns a 14% stake in Apollo.

While he was CEO, Black oversaw several high-stakes investments, including distressed assets and buyouts, earning massive returns for the firm. His ability to navigate financial crises enabled Apollo to profit immensely.

In addition to Apollo, Black has investments in real estate and art. His art collection is particularly notable, including pieces by renowned artists such as Edvard Munch. The value of his art collection adds another dimension to his wealth.

Key Points:

- Founder: Apollo Global Management

- Assets Managed by Apollo: $600 billion

- Stake in Apollo: 14%

- Other Investments: Real estate, art collection

- Net Wealth: Estimated by Forbes at $13.6 billion as of August 2024

His strategic decisions and investments have solidified his position as one of the wealthiest individuals in finance, directly impacting the landscape of private equity.

Private Equity Influence

Leon Black’s significant wealth stems largely from his success in private equity as the co-founder of Apollo Global Management.

Founded in 1990, Apollo has grown to manage approximately $600 billion in assets. Specialising in distressed assets, they buy struggling companies, improve their efficiency, and sell them for a profit.

Black’s role at Apollo enabled him to make strategic decisions, contributing to the firm’s impressive growth.

In 2021, Black stepped down as Apollo’s CEO and chairman. This decision followed scrutiny of his financial dealings with Jeffrey Epstein.

Apollo’s influence in private equity is considerable, investing in various industries like energy, manufacturing, and real estate. The firm’s high returns on investment have enhanced Black’s wealth and solidified his status in finance.

Philanthropy and Art Collection

Leon Black is known for his significant contributions to philanthropy and art.

Philanthropy

He and his wife, Debra, lead the Leon Black Family Foundation, focusing on arts and culture. They support various New York City art institutions, and Leon has served on several boards, including the Museum of Modern Art.

Art Collection

Leon Black has an impressive art collection estimated at $1 billion. In 2012, he purchased Edvard Munch’s “The Scream” for $120 million, highlighting his interest in notable and high-value artworks.

Key Highlights

- Foundation: Leon Black Family Foundation

- Focus: Arts and cultural institutions

- Significant Purchase: Edvard Munch’s “The Scream”

Through significant donations and strategic purchases, Black plays a prominent role in supporting and preserving the arts. More details about his art deals and philanthropy reveal his tactical approach to managing his wealth and influence in these fields.

Influence on Financial Industry

Leon Black has had a significant impact on the financial industry. As the co-founder of Apollo Global Management, he played a key role in building one of the world’s largest and most powerful private equity firms.

Apollo is known for its aggressive investment strategies, acquiring numerous companies across various industries. Black’s financial acumen and deep knowledge of distressed assets allowed Apollo to thrive, particularly during economic downturns.

Key Contributions:

- Pioneering Private Equity: Popularised leveraged buyouts.

- Distressed Investments: Showcased the ability to find value in challenging situations.

- Industry Leadership: Made Apollo a model for other private equity firms.

Despite his contributions, Black faced controversy, including his financial ties with Jeffrey Epstein.

Apollo’s relationship with creditors and investors positioned it as a formidable player on Wall Street. Black’s ability to adapt and navigate complex financial landscapes cemented his reputation as a powerful financier.

In summary, Leon Black’s strategies and bold moves in private equity have left a lasting mark on the financial industry, shaping the way modern private equity operates.

The Role of Networking and Partnerships

Networking and partnerships were crucial in Leon Black’s rise to financial success. As the co-founder of Apollo Global Management, Black built strong relationships with influential figures and firms in finance.

He worked closely with other investment professionals, leveraging their expertise to make informed decisions. These partnerships allowed him to pool resources and share risks, contributing significantly to Apollo’s growth.

Key Relationships:

- Close ties with successful entrepreneurs and investors.

- Strategic alliances with major financial institutions.

- Collaborations with industry experts for specialised advice.

One notable partnership was Black’s interaction with Jeffrey Epstein. Although controversial, Epstein provided tax and estate-planning advice, leading to a significant financial impact, as Black paid him USD 158 million.

Developing strong networks helped Black access otherwise unavailable investment opportunities. He was able to identify and capitalise on lucrative deals, further cementing his reputation.

By maintaining good relationships with clients and stakeholders, Black ensured a steady flow of investments and created a loyal client base. His ability to connect with influential individuals and organisations played a vital role in his success.

Apart from financial partnerships, Black’s social connections also helped him navigate challenges and controversies. These relationships provided support and advice, allowing him to manage public scrutiny effectively.

Networking and forming strategic partnerships were essential aspects of Leon Black’s strategy, enabling him to build a successful career in finance.

Controversies and Challenges

Leon Black’s career has been marked by several controversies.

One major issue involved his payments to Jeffrey Epstein. Black reportedly transferred $158 million to Epstein over several years, raising questions about their relationship and why such a large sum was given.

There were multiple instalments. In 2013, Black allegedly paid Epstein $50 million. The following year, another $70 million was transferred. In 2015, he gave $30 million and later made a $10 million donation to Gratitude America.

This connection had significant implications. Black announced he was stepping down as CEO of Apollo Global Management, citing the “relentless” impact of the Epstein investigation on his health.

Black’s ties to Epstein were a stark reminder of how relationships with controversial figures can affect one’s career and reputation. Black’s involvement with Epstein also led to a settlement with the U.S. Virgin Islands for $62.5 million in cash.

Black also experienced scrutiny from media outlets and regulatory bodies. Forbes and the BBC covered these developments, highlighting the toll on his professional standing.

Despite his achievements, these incidents have been significant challenges for Leon Black, affecting both his personal and professional life.

Current Position and Activities

Leon Black is no longer actively involved with Apollo Global Management. After stepping down as CEO in March 2021, he maintained a low profile.

In January 2023, Black agreed to pay $62.5 million to the Virgin Islands government to avoid legal claims related to Jeffrey Epstein.

Outside of financial settlements, Black continues to focus on other ventures. He remains an active art collector and philanthropist. His net worth, estimated at just over $13 billion, allows him to support various causes.

Black’s activities in the art world are significant. He owns many high-value pieces and contributes to museums, showcasing his passion for art history.

Additionally, Black’s philanthropic efforts extend to educational and cultural institutions. He has donated substantial amounts to universities and cultural projects, reflecting his commitment to supporting education and the arts.

In summary, Leon Black’s current activities involve managing his wealth, resolving legal issues, and pursuing his interests in art and philanthropy. His continued influence and potential new ventures make him a figure to watch in the finance and art worlds.

Future Outlook

Despite stepping down as CEO of Apollo, Leon Black remains an influential figure in the finance world. His future ventures may include further philanthropic efforts, continued investment in the art world, and potential new business opportunities.

Potential Ventures:

- New Business Initiatives: Black may explore new investment opportunities or start new ventures in different industries. His experience and expertise could lead to successful projects in emerging markets or innovative sectors.

- Increased Philanthropy: With more time available, he might expand his philanthropic activities, supporting more cultural and educational initiatives. His foundation could take on new projects that align with his interests and values.

Quotes and Testimonials

Industry Insights:

- Colleague Testimonials: “Leon Black’s vision and strategic acumen have always set him apart in the financial industry,” says a former colleague at Apollo. His ability to identify high-potential investments and execute complex deals has been a key factor in his success.

- Black’s Perspective: In an interview, Black mentioned, “Success in investing is about seeing potential where others see risk.” This mindset has driven many of his most successful ventures and has been a guiding principle in his career.

These quotes provide insight into Black’s character and business philosophy, highlighting the attributes that have contributed to his impressive career.

Lessons from Leon Black’s Journey

Leon Black’s path to wealth offers valuable insights and lessons for aspiring entrepreneurs, investors, and business leaders. Here are some key takeaways:

Strategic Investment

- Identify Undervalued Opportunities: Black’s success was significantly built on identifying and investing in distressed or undervalued companies. Recognising potential where others see risk can lead to substantial returns.

- Long-term Perspective: Instead of focusing on short-term gains, Black often held assets longer to realise their full value. Patience and a long-term view are crucial in investment strategy.

- Diversification: Spreading investments across various sectors helps in managing risk and capitalising on multiple growth opportunities.

Leadership and Innovation

- Innovation in Finance: Black was part of pioneering efforts in the high-yield bond market at Drexel Burnham Lambert, showcasing the importance of innovation in achieving financial success.

- Adaptability: Throughout his career, Black demonstrated the ability to adapt to changing market conditions and navigate complex financial landscapes. Flexibility and resilience are essential traits for success.

Networking and Relationships

- Build Strong Networks: Black’s career highlights the importance of networking and forming strategic partnerships. Collaborating with other experts and leveraging their knowledge can lead to better decision-making and opportunities.

- Value of Mentorship: Working closely with influential figures like Michael Milken provided Black with invaluable experience and insights. Seeking mentorship and learning from successful individuals can accelerate one’s growth.

Ethical Considerations

- Reputation Management: The controversies surrounding Black, particularly his association with Jeffrey Epstein, underscore the impact of personal relationships on one’s career and reputation. Maintaining ethical standards and transparency is critical.

- Handling Public Scrutiny: Black’s ability to navigate public scrutiny and legal challenges illustrates the importance of crisis management skills and having a solid support system.

Philanthropy and Personal Interests

- Give Back: Black’s extensive philanthropic efforts and support for the arts demonstrate the importance of giving back to the community. Successful individuals should consider how they can contribute to society.

- Pursue Personal Interests: Balancing business with personal passions, like Black’s involvement in art collection, can lead to a more fulfilling life. It’s essential to nurture interests outside of work.

Continuous Learning and Improvement

- Education as a Foundation: Black’s strong educational background from Dartmouth and Harvard Business School provided a solid foundation for his career. Continuous learning and self-improvement are vital for long-term success.

- Analytical Rigor: Making decisions based on thorough analysis and data, as Black did, reduces guesswork and enhances the likelihood of success.

Vision and Execution

- Clear Vision: Having a clear mission, as Black did when founding Apollo Global Management, helps in setting a strategic direction and aligning efforts towards common goals.

- Execution Excellence: Vision alone is not enough; executing plans effectively is crucial. Black’s ability to turn around distressed companies shows the importance of implementation in achieving success.

Frequently Asked Questions

Leon Black’s wealth comes from various sources, including significant investments and leadership in Apollo Global Management. Here are common questions about his financial success and personal background:

What are the sources of Leon Black’s wealth?

Leon Black’s wealth originates from his co-founding and management of Apollo Global Management. He has invested in multiple industries, leveraging his expertise in private equity.

How much is Leon Black’s net worth?

Leon Black’s net worth was estimated to be around $13.6 billion as of August 2024. This valuation underscores his success in finance and investments.

What businesses did Leon Black invest in to accumulate his fortune?

Leon Black built his fortune through strategic investments in distressed debt, private equity, and real estate. Apollo Global Management played a pivotal role in these investments, driving significant returns.

Has Leon Black sold a significant amount of stock in Apollo Global Management?

Leon Black has made significant stock sales in Apollo Global Management over time. These transactions have contributed to his liquidity and personal wealth.

Who is in Leon Black’s immediate family?

Leon Black’s immediate family includes his wife, Debra Black, and their children. His family background provides insight into his personal life behind his business success.