Last Updated on October 8, 2024 by Vlad

How did David Tepper get rich? His journey to wealth is a story of financial expertise and strategic decision-making. Born in Pittsburgh, Pennsylvania, Tepper demonstrated an early interest in finance and economics. He laid the foundation for his career by studying at the University of Pittsburgh, earning a degree that set the stage for his later success.

Tepper amassed his fortune primarily through his hedge fund, Appaloosa Management, which he founded in 1993. His ability to identify distressed assets and make bold investment decisions became his trademark in the financial world. Tepper’s talent for spotting opportunities in struggling companies and turning them into profitable ventures distinguished him from his peers.

One of Tepper’s most famous trades occurred during the 2008 financial crisis. He bought large stakes in failing banks, betting that government intervention would help them recover. This decision paid off, earning billions for his fund and solidifying his status as a shrewd investor. Today, Tepper’s net worth is estimated at over AU$31 billion, placing him among the wealthiest people globally.

Key Takeaways

- Tepper’s wealth came primarily from his hedge fund, Appaloosa Management.

- His investment strategy focuses on distressed assets and undervalued opportunities.

- Tepper’s bold moves during the 2008 financial crisis significantly boosted his wealth.

Early Life and Education

David Alan Tepper was born on 11 September 1957 in Pittsburgh, Pennsylvania, into a middle-class Jewish family. Understanding how David Tepper got rich involves looking at his early fascination with numbers and investments. From a young age, Tepper showed a fascination with numbers and investments, often studying stock tables in the newspaper with his father.

He attended Peabody High School, excelling in mathematics before graduating in 1975. Tepper then pursued a bachelor’s degree in economics at the University of Pittsburgh, graduating with honours in 1978.

After a few years in the workforce, Tepper decided to advance his education and enrolled at Carnegie Mellon University’s business school. He earned his MBA in 1982, a pivotal step that shaped his future career in finance.

Tepper’s strong analytical skills and interest in financial markets would form the foundation of his future successes in hedge fund management.

Launching His Financial Career

Goldman Sachs

In 1985, Tepper joined Goldman Sachs as a credit analyst, where he quickly rose to become the head trader on the high-yield desk. Here, he specialised in junk bonds and distressed debt, refining his skills in identifying undervalued opportunities in troubled companies.

His time at Goldman was marked by successful deals and significant profits, particularly during the 1987 stock market crash, when his bold trades turned market chaos into personal gains.

Investment Philosophy

Tepper’s investment strategy revolves around finding value in distressed situations. He focuses on companies with strong fundamentals but temporary financial difficulties, betting on their recovery.

His approach involves deep analysis of a company’s debt and turnaround potential. Known for taking calculated risks, Tepper is unafraid to make large, concentrated bets when the opportunity presents itself.

Despite his bold moves, Tepper balances risk by investing in more stable assets to protect against market downturns. His patience and conviction have allowed him to hold positions long enough to see significant returns.

Founding Appaloosa Management

In 1993, Tepper founded Appaloosa Management with $57 million in capital. The firm’s focus on distressed debt investing set it apart, buying bonds of financially troubled companies at steep discounts. Tepper capitalised on these assets when the companies either recovered or went bankrupt.

Breakthrough Investments

Appaloosa’s big breakthrough came during the 2008 financial crisis. Tepper made significant investments in Bank of America and Citigroup, purchasing their shares at rock-bottom prices when others were fleeing the market.

His bet on a government bailout of the banks proved lucrative. As these institutions rebounded, Appaloosa’s investments soared, netting billions in profits. Tepper’s strategic bets during this period are still studied by investors today.

Another notable trade involved the failed energy company Enron. Tepper bought its bonds for pennies on the dollar and later sold them for a substantial profit as the company’s assets were liquidated.

Detailed Analysis of Tepper’s Investment Strategies

David Tepper’s investment philosophy is rooted in finding value where others see risk. His primary focus has been on distressed debt investing, which involves buying the debt of companies in financial trouble at a discount, with the expectation that these companies will either recover or go through a bankruptcy process that preserves value.

Tepper has a unique ability to assess the long-term value of distressed companies, digging deep into their financials to determine if they have strong underlying assets or the potential for a successful turnaround. This approach requires not only financial acumen but also a tolerance for high risk. Tepper’s investments in distressed debt are often large, concentrated bets that reflect his confidence in the company’s recovery.

Another crucial aspect of Tepper’s strategy is his ability to hedge his positions. He carefully balances his high-risk investments with more stable assets to mitigate potential losses. This strategy allows him to remain aggressive in his pursuit of distressed assets while protecting his capital from market volatility.

Tepper also employs macroeconomic analysis in his investments, particularly in his bets during the 2008 financial crisis. His deep understanding of how government actions affect the markets allows him to predict when distressed companies are likely to benefit from regulatory interventions.

2008 Financial Crisis

The 2008 financial crisis was a turning point not just for David Tepper, but for the entire global economy. At the time, many of the world’s largest banks were on the brink of collapse, their stocks plummeting amid fears of insolvency. Tepper saw this as a once-in-a-lifetime opportunity.

While other investors were pulling out of the financial sector, Tepper made significant investments in banks like Bank of America and Citigroup. His reasoning was simple: he believed that the US government would not allow these banks to fail. Tepper anticipated that the government would intervene to stabilise the financial system, and his bet was that these banks would recover with the help of bailout funds.

Tepper’s strategy during the crisis involved buying these banks’ stocks at rock-bottom prices. As the government rolled out TARP (Troubled Asset Relief Program), Tepper’s investments surged in value, earning his firm billions of dollars. His success during the financial crisis cemented his reputation as one of the savviest investors on Wall Street.

Tepper’s Impact on the Hedge Fund Industry

David Tepper has left a lasting mark on the hedge fund industry, both through his own firm, Appaloosa Management, and his influence on the broader financial community. Appaloosa’s success in the 2008 financial crisis, where the firm made billions while many others struggled, elevated Tepper to legendary status.

Tepper’s bold, high-conviction trades have inspired other hedge fund managers to pursue similar strategies. His willingness to invest in distressed debt and struggling companies has reshaped how hedge funds view risk, particularly in volatile economic environments.

Appaloosa’s transparency with investors about its strategies and performance has also influenced how hedge funds communicate with their clients. Tepper has always been clear about his firm’s objectives, helping to build trust with investors even during turbulent times.

Major Trades and Success Stories

David Tepper’s wealth comes from his smart investments during critical market periods, particularly during downturns.

The GFC

In 2009, as the financial sector was in turmoil, Tepper made a calculated bet on major banks like Bank of America and Citigroup. He purchased their shares at rock-bottom prices, confident that government intervention would prevent them from failing. This bold example stands out when examining just how did David Tepper get rich.

His risky move paid off. As these banks recovered, Tepper’s hedge fund earned $7 billion, with Tepper personally pocketing $4 billion. This trade cemented his reputation as an investor capable of turning crisis into fortune.

Tepper’s Ownership of Sports Teams

In 2018, David Tepper expanded his investment portfolio by purchasing the Carolina Panthers, an NFL team, for a reported $2.2 billion. This marked the first time Tepper ventured into sports team ownership, a move that showcased his business acumen beyond the world of finance. Tepper’s purchase of the Panthers made headlines as it was the largest transaction for an NFL team at the time.

Tepper’s interest in sports didn’t stop there. In 2019, he acquired Charlotte FC, a Major League Soccer (MLS) expansion team, further diversifying his holdings. His investments in sports teams not only serve as profitable ventures but also represent his commitment to community involvement and regional development. Tepper has expressed his desire to build long-term success for both teams while contributing to the local economies.

His entry into sports ownership highlights the crossover between finance and entertainment, a space where many billionaires are increasingly investing. Sports teams can be highly lucrative, providing both short-term revenues and long-term appreciation in franchise value.

Tepper’s Role in Economic and Financial Policy

Tepper is more than just a hedge fund manager—he is also a thought leader in the world of finance. His insights into economic policy and market trends have made him a frequent guest on financial news outlets such as CNBC. Tepper’s ability to articulate complex financial concepts in simple terms has made him a trusted voice for many investors.

Over the years, Tepper has been vocal about his views on Federal Reserve policies, inflation, and market regulation. His opinions carry weight on Wall Street, and he has been known to influence market sentiment with his comments.

One example of his influence was his outspoken support of the Federal Reserve’s quantitative easing measures in the wake of the 2008 crisis. Tepper’s bullish outlook during a period of uncertainty helped to restore confidence in the markets.

Challenges and Setbacks

While Tepper’s career has been marked by incredible successes, it hasn’t been without challenges. Like any investor, Tepper has faced setbacks, particularly when markets don’t behave as expected. One of the notable challenges came during the dot-com bubble of the early 2000s, when many tech stocks plummeted, causing losses for numerous investors, including Tepper.

Tepper has also been candid about the psychological toll that investing can take, especially during periods of extreme market volatility. Despite his wealth and success, Tepper has admitted to feeling the pressure when markets turn against him. However, his resilience and ability to bounce back from difficult periods have been key to his long-term success.

Philanthropy and Personal Life

Tepper has used his vast wealth to give back to society through charitable donations and philanthropic efforts.

Charitable Work

Tepper has donated millions to educational initiatives, including a $67 million gift to Carnegie Mellon University, which renamed its business school in his honour. He has also contributed significantly to disaster relief efforts, such as providing $200,000 in gift cards to victims of Hurricane Sandy.

In addition to education and disaster relief, Tepper supports various health and Jewish causes. He has made substantial donations to hospitals and Jewish charities, including Chabad House.

In his personal life, Tepper is married with three children and owns both the Carolina Panthers NFL team and the Charlotte FC soccer club. His interests outside finance include sports and community involvement.

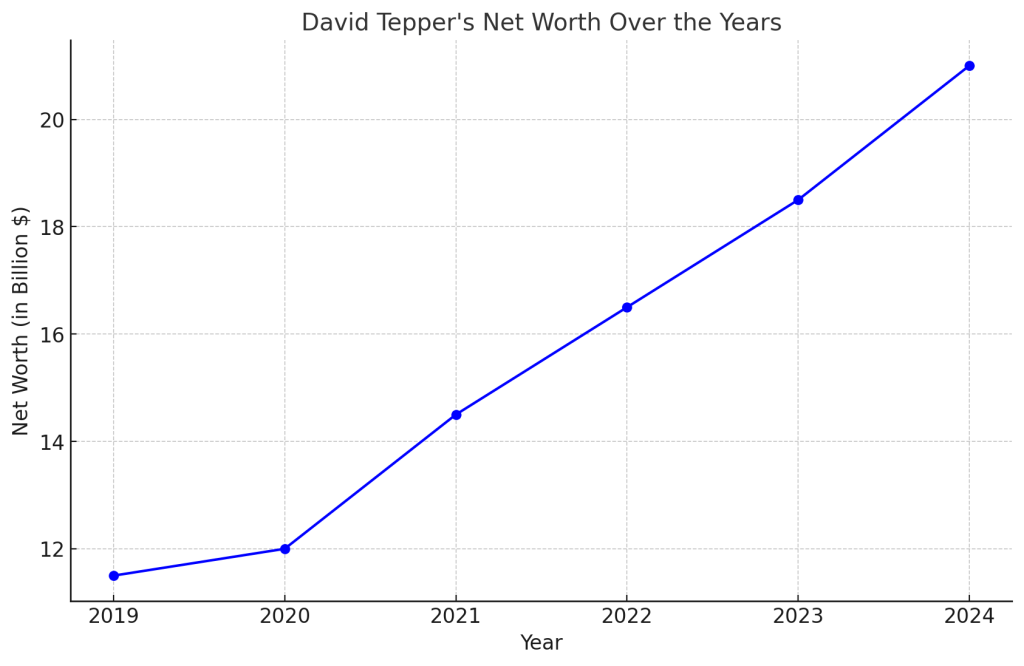

Net Worth

As of October 2024, David Tepper’s net worth is estimated at an impressive $21.3 billion by Forbes, while the Bloomberg Billionaires Index has Tepper’s net worth at $21.2 billion.

Most of David’s wealth comes from the funds he runs at his Appaloosa Management.

Mr. Tepper’s wealth has grown substantially over the last few years as can be seen from the graph below.

Comparing David Tepper to Other Investment Titans

David’s success places him in the ranks of other renowned investors and financial moguls, but his approach and path to riches differ in several key ways from figures like Warren Buffett, Ray Dalio, and Carl Icahn. Let’s see how Tepper compares to these titans of finance.

Tepper vs Buffett

Investment Style: Warren Buffett is famous for his long-term value investing strategy, focusing on well-established companies with strong fundamentals and holding onto them for years, if not decades. In contrast, how David Tepper got rich is largely through distressed debt investing—buying companies or assets that are in trouble but have the potential to recover. Tepper’s strategy involves much more risk and shorter-term bets.

Risk Appetite: Buffett avoids risky or speculative investments, while Tepper thrives in high-risk environments, especially in times of market turmoil, such as the 2008 financial crisis.

Tepper vs Dalio

Philosophy and Approach: Ray Dalio, the founder of Bridgewater Associates, built his fortune using a highly analytical and systematic approach, relying heavily on macroeconomic trends and principles of economic cycles. While Tepper also employs macroeconomic analysis in his strategy, he is much more willing to take aggressive, large-scale bets on distressed companies. How did David Tepper make his money? By seizing high-risk, high-reward opportunities, unlike Dalio’s more calculated and diversified strategies.

Transparency: Dalio is known for his radical transparency and principled approach to management, while Tepper focuses more on results and bold decision-making rather than strict adherence to principles.

Tepper vs Icahn

Activist Investing: Carl Icahn made his name as an activist investor, taking large positions in companies and pushing for changes in management or strategy to increase shareholder value. While Tepper has dabbled in activism, his primary focus has been on distressed debt and making timely trades in underperforming sectors. Icahn’s influence is exerted through active involvement in the companies he invests in, whereas Tepper prefers to focus on making smart trades with less direct involvement in corporate governance.

Risk Profile: Both Tepper and Icahn have a high tolerance for risk, but how David Tepper got rich involved making opportunistic bets during periods of market downturns, whereas Icahn’s wealth comes more from restructuring companies from the inside out.

Tepper vs Soros

Market Timing: George Soros is famous for his “breaking the Bank of England” trade, where he bet against the British pound and made billions in a short period. Similarly, Tepper made his fortune during the 2008 financial crisis by betting on distressed banks. Both are known for their incredible market timing and ability to make high-conviction bets when others are fearful.

Philanthropy: Both Tepper and Soros are known for their philanthropy, but Soros is highly active in political causes and global humanitarian efforts, while Tepper has focused more on education, disaster relief, and local community initiatives.

Timeline of Key Events in Tepper’s Career

- 1957: David Tepper is born in Pittsburgh, Pennsylvania.

- 1978: Graduates from the University of Pittsburgh with a degree in economics.

- 1982: Earns an MBA from Carnegie Mellon University.

- 1985: Joins Goldman Sachs as a credit analyst, later becoming head of the high-yield desk.

- 1993: Founds Appaloosa Management with $57 million in capital.

- 2008-2009: Makes bold investments in Bank of America and Citigroup during the financial crisis, earning billions.

- 2018: Purchases the Carolina Panthers NFL team for $2.2 billion.

- 2019: Acquires Charlotte FC, an MLS expansion team.

- 2023: Tepper’s net worth is estimated at over AU$31 billion.

Tepper’s Influence on Wall Street and Investors

David Tepper is one of the most respected figures on Wall Street, and his influence extends beyond his hedge fund. His bold moves during the financial crisis and his continued success have inspired a new generation of investors. Tepper’s ability to remain calm and rational during periods of market panic has been a model for others in the industry.

His investment strategies, particularly his focus on distressed assets, have changed the way many hedge funds approach risk. Tepper’s success has shown that with the right analysis and timing, significant gains can be made even in the most challenging markets.

His transparency and candidness about his investment decisions have made him a trusted figure among both institutional and retail investors. When Tepper speaks, markets listen, and his insights are often a guiding force for those looking to navigate uncertain economic times.

Lessons from David Tepper

David’s life and his business success offer a number of lessons that we can all learn from.

Courage in the Face of Risk

One of Tepper’s most defining traits is his willingness to make bold bets when others are fearful. During the 2008 financial crisis, while most investors were panicking and selling off their shares, Tepper saw opportunity and made huge investments in struggling banks like Bank of America and Citigroup.

Lesson: Being willing to take calculated risks when others are retreating can lead to enormous rewards. Having the courage to trust your analysis and act against the crowd is key in both investing and business.

Thorough Analysis and Deep Research

Tepper’s success is built on his ability to thoroughly understand distressed companies. He doesn’t make investments based on emotion or trends but on deep research into a company’s financials, debt structure, and recovery potential.

Lesson: Proper due diligence and detailed research are essential for making informed investment decisions. Know what you are investing in and why.

Patience and Long-Term Thinking

Tepper is known for his patience and conviction. He is willing to hold investments for extended periods if he believes in their long-term value. His success is often a result of waiting for the right opportunity and having the discipline to stay committed to his strategy.

Lesson: Success doesn’t always come quickly. Having patience and a long-term mindset can often result in greater gains.

Diversify and Hedge Risk

Although Tepper is known for his big, bold bets on distressed companies, he also hedges his risks by diversifying his portfolio and balancing his high-risk investments with more stable ones. This approach protects him from potential losses while still allowing him to be aggressive when needed.

Lesson: Even if you are willing to take risks, it’s important to have a balanced portfolio. Diversification is crucial for managing risk and protecting your investments.

Seize Opportunities in Market Turmoil

Tepper’s philosophy has always been to see opportunities where others see disaster. He was one of the few investors who profited massively from the financial crisis, proving that even in a downturn, there are chances to grow wealth.

Lesson: Economic downturns and market crashes aren’t necessarily bad for investors—if you are prepared, they can present some of the best opportunities for growth.

Resilience Through Setbacks

Like any investor, Tepper has experienced failures and setbacks, such as during the dot-com bubble. However, he has always been able to recover, using these challenges as learning opportunities to refine his strategy.

Lesson: Setbacks are inevitable in any venture, but resilience, learning from mistakes, and continuing to push forward are essential to long-term success.

Philanthropy and Giving Back

Tepper has used his wealth to give back to society, particularly in education and disaster relief. His generous donations to Carnegie Mellon University, healthcare initiatives, and other causes demonstrate that wealth is not just for personal gain.

Lesson: Success is not just about personal wealth—using your resources to improve the world around you can leave a lasting legacy and create positive change.

Stay Calm Under Pressure

Tepper is known for his ability to stay calm in times of extreme market volatility. His rational and level-headed approach allows him to make clear decisions when others might be paralysed by fear.

Lesson: Emotional control is crucial in investing and business. Being able to remain composed under pressure ensures better decision-making and can help avoid costly mistakes.

Adapt to Changing Conditions

Tepper has demonstrated an ability to adjust his strategies based on market conditions, whether it be in the hedge fund world or his entry into sports team ownership. This flexibility has been a key part of his success.

Lesson: Flexibility and adaptability are key to staying ahead in any industry. As markets and industries evolve, being willing to adjust your strategy is essential.

Build a Solid Team

Appaloosa Management’s success isn’t just Tepper’s alone. He has surrounded himself with a team of smart, capable people who help execute his strategies and manage his portfolio.

Lesson: Success is rarely a solo endeavour. Building and working with a team of talented individuals can amplify your strengths and lead to greater achievements.