Last Updated on September 19, 2024 by Vlad

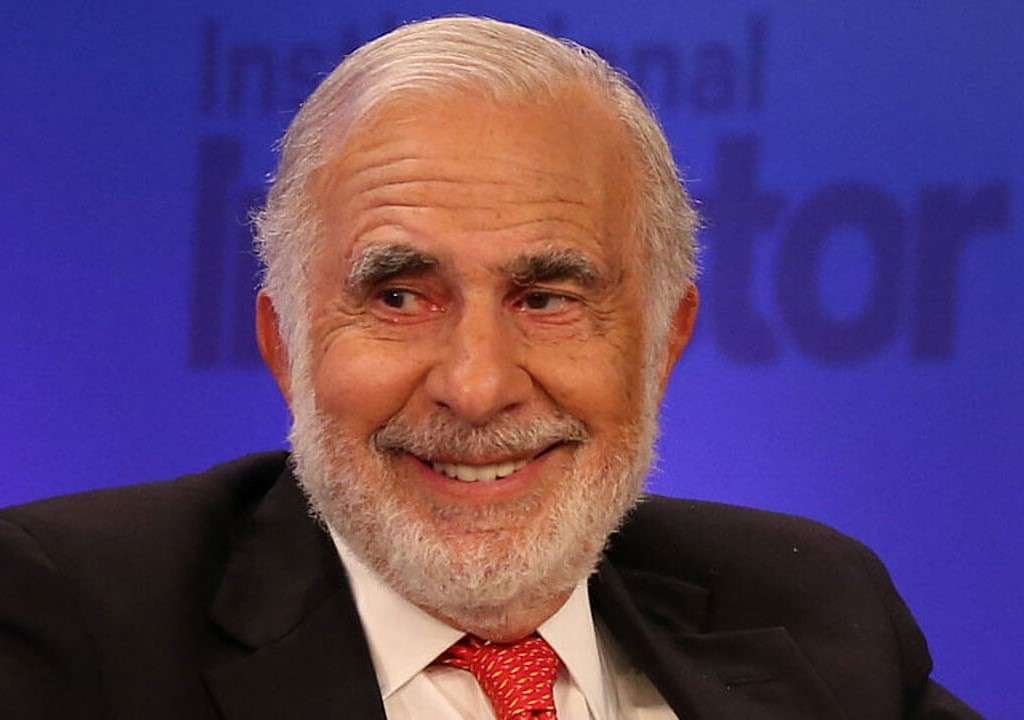

Carl Icahn is a well-known figure in the business world. How did Carl Icahn get rich? He built his fortune through bold investments and strategic decisions that transformed corporate America. His story is one of sharp business acumen and relentless determination.

Icahn became rich by buying large stakes in companies and pushing for changes that boosted their value. Starting with small deals, he quickly expanded his influence by restructuring companies and shaking up management.

Icahn’s ability to spot undervalued companies has been key to his success. He often sees opportunities others overlook and isn’t afraid to take risks. Although his methods have drawn both praise and criticism, his wealth continues to grow.

Key Takeaways:

- Icahn built his wealth by investing in undervalued companies.

- He is known for pushing for changes in the companies he invests in.

- His bold approach and willingness to take risks have led to his financial success.

Carl Icahn’s Timeline

- 1936: Born on February 16 in Far Rockaway, Queens, New York City.

- 1957: Graduated from Princeton University with a degree in Philosophy.

- 1960s: Began career on Wall Street, working as an options trader.

- 1968: Founded Icahn & Co., his own securities firm.

- 1978: Achieved first major success with the Tappan Company, profiting from the sale.

- 1985: Gained control of Trans World Airlines (TWA) through a hostile takeover.

- 1987: Launched a takeover bid for Texaco, leading to a $3 billion settlement.

- 1990s: Established his reputation as a corporate raider, engaging in several high-profile takeovers and proxy battles.

- 2008: Navigated the financial crisis by investing in distressed assets.

- 2013: Took a large stake in Apple, pressuring the company to increase stock buybacks.

- 2016: Sold his shares in Apple, citing concerns about China’s economic slowdown.

- 2023: Faced an inquiry by US prosecutors following a short-seller report questioning his business practices.

- 2024: Estimated net worth stands at $16 billion.

Early Life and Education

Carl Icahn was born on 16 February 1936 in Far Rockaway, Queens, New York City. Raised in a modest household, both of his parents were teachers. His father also worked as a lawyer and a Jewish cantor, exposing young Carl to diverse professional influences early on.

Despite growing up in a poor neighbourhood, Icahn excelled academically. He attended Far Rockaway High School, where he developed a strong interest in philosophy and mathematics. After high school, he went on to earn a Bachelor of Arts degree in philosophy from Princeton University in 1957. Though he briefly attended New York University School of Medicine, he quickly realised his passion lay elsewhere, a decision that set him on the path to his future success.

Early Career in Wall Street

Carl Icahn’s journey to wealth began on Wall Street in the 1960s, where he gained recognition through savvy trading.

Options Trading

Icahn started his career as an options trader, using his knowledge of options contracts to make profitable trades. His knack for spotting undervalued stocks paid off, enabling him to build the capital needed for larger deals.

Launching His Brokerage Firm

In the late 1960s, Icahn launched his brokerage firm, focusing on risk arbitrage and options trading. The firm thrived, thanks to his sharp eye for market trends and the valuable relationships he built on Wall Street. By the mid-1970s, Icahn had amassed enough wealth to start buying significant stakes in companies, marking his shift from trader to corporate raider.

Foundation of Icahn & Co.

In 1968, Carl Icahn founded his own securities firm, laying the foundation for his future success as an activist investor.

Investment Philosophy

Icahn’s investment strategy cantered on identifying undervalued companies with strong assets but weak management. He believed in active ownership, using his influence to push for changes that increased shareholder value.

Early Wins

One of his first major successes was with the Tappan Company in 1978, where he bought a large stake and forced a sale at a profit. His 1985 takeover of TWA airlines and involvement in Texaco in 1987 were similarly successful and established his reputation as a skilled corporate raider.

The Corporate Raider Reputation

Icahn earned his reputation as a corporate raider through his aggressive tactics. He made his money largely through hostile takeovers and proxy battles, where he pushed for changes in companies.

Hostile Takeovers

Icahn became known for hostile takeover attempts, where he would acquire large shares in a company and push for management changes. This approach often involved replacing the board of directors to drive the changes he deemed necessary to increase value.

Proxy Battles

When hostile takeovers weren’t possible, Icahn resorted to proxy battles, rallying shareholders to support his proposed changes. His public campaigns, combined with his financial resources, made him a formidable opponent in these corporate conflicts.

Influence on Modern Activist Investing

Icahn’s methods of activist investing have left a lasting legacy. By buying large stakes in companies and demanding changes that would increase shareholder value, he redefined the role of shareholders. Icahn’s approach inspired many other investors, like Bill Ackman and Paul Singer, to follow suit.

His aggressive style gave rise to the “Icahn Lift,” where a company’s stock would often rise just from the news of his involvement. This new approach to shareholder activism pushed companies to be more transparent and accountable to their investors, forever changing corporate governance.

Major Investments and Strategies

Icahn’s fortune was built on a series of strategic investments and aggressive business moves. These tactics explain how Carl Icahn made his money and built his reputation in the business world.

Private Equity Ventures

Icahn’s ventures into private equity, including his 1985 takeover of TWA, were key drivers of his wealth. His ability to streamline operations and sell off assets in distressed companies brought significant profits.

Activist Shareholder Roles

Icahn’s activist investing style involved buying large stakes in public companies and pushing for strategic changes to boost stock prices. This often led to the “Icahn lift,” where stock prices would rise following news of his involvement.

Distressed Asset Acquisitions

Icahn made a name for himself by purchasing distressed assets, restructuring companies, and selling non-core assets to generate profits. His ability to turn struggling businesses around became legendary.

Role in the 2008 Financial Crisis

During the 2008 financial crisis, when many investors saw their fortunes dwindle, Icahn thrived by sticking to his strategy of investing in distressed assets. He took advantage of discounted debt and used his influence to restructure these companies.

While others scrambled, Icahn remained focused on long-term gains, positioning himself to profit when the markets recovered. His experience navigating downturns and seizing opportunities further solidified his reputation as a master strategist.

Notable Corporate Engagements

Icahn’s aggressive investment tactics led to several high-profile corporate engagements that shaped his career.

Texaco Acquisition

In 1987, Icahn launched a takeover bid for Texaco, which was struggling with bankruptcy. Though he didn’t gain control of the company, his efforts led to a $3 billion settlement, netting him a substantial profit.

TWA Takeover

Icahn gained control of Trans World Airlines (TWA) in 1985, taking the company private and selling off key assets. While the airline eventually filed for bankruptcy, Icahn made significant personal profits from the takeover.

Influence at Apple

Icahn’s large investment in Apple in 2013 led to significant increases in stock buybacks and dividends. His influence on one of the world’s biggest companies underscored his ability to shape corporate strategy.

Investments in Technology

Icahn’s success wasn’t limited to traditional industries. His strategic move into tech, including large stakes in Apple, Netflix, and eBay, demonstrated his adaptability in fast-moving markets.

Icahn’s 2013 investment in Apple was particularly notable. He advocated for higher dividends and stock buybacks, significantly influencing the company’s financial strategy. Although he sold his Apple shares in 2016, citing concerns about China, his involvement showcased his ability to recognise value in a tech-driven world.

Challenges Faced and Lessons Learned

Despite his long list of successes, Icahn has also faced setbacks. His takeover of Trans World Airlines (TWA) is one of his most criticised moves. While Icahn made personal profits, the company struggled under his leadership and eventually filed for bankruptcy.

Icahn also dealt with legal scrutiny throughout his career. His hostile takeover attempts often resulted in lawsuits, and his business practices have come under investigation by regulators. Despite these challenges, Icahn learned from his mistakes, refining his strategies and becoming more resilient as an investor.

Impact on Shareholders and the Broader Economy

Carl Icahn’s activism has left a profound mark on shareholders and the corporate world. His insistence on maximising shareholder value through increased dividends, buybacks, and improved management forced companies to be more accountable. This shift in focus benefited not only investors but also reshaped corporate governance practices across America.

Icahn’s challenges to CEOs and management teams pressured companies to reconsider their priorities. His influence reached beyond the boardroom, inspiring other investors to push for corporate transparency and better shareholder returns.

Legal and Regulatory Challenges

Icahn’s aggressive tactics often led to legal and regulatory scrutiny, especially during his hostile takeover attempts. He faced lawsuits from target companies and was investigated by the Securities and Exchange Commission (SEC) on multiple occasions. More recently, his company faced an inquiry from US prosecutors in 2023, following a short-seller report.

Philanthropy and Personal Life

Carl Icahn is not only known for his aggressive business tactics but also for his substantial philanthropic efforts. Over the years, he has donated millions of dollars to causes close to his heart, focusing mainly on education, healthcare, and the arts.

Education and Charter Schools

One of Icahn’s biggest philanthropic contributions has been in the field of education. In 2001, he established the Carl C. Icahn Foundation, through which he supports various initiatives. One of his most notable efforts is his support for charter schools. Icahn founded the Icahn Charter Schools network in New York City, which now operates several schools. These institutions serve underprivileged children, providing them with a quality education and consistently achieving higher-than-average test scores. Icahn’s commitment to education stems from his belief that access to quality learning can transform lives, just as his own education at Princeton laid the foundation for his success.

Healthcare Contributions

Icahn’s contributions to healthcare are also significant. He has donated hundreds of millions of dollars to medical institutions, including a $200 million donation to the Icahn School of Medicine at Mount Sinai in New York, which was renamed in his honour. His donations support cutting-edge research and the training of the next generation of healthcare professionals. Icahn’s involvement in healthcare philanthropy shows his belief in the importance of medical advancement and education, as well as his desire to leave a lasting impact on the industry.

Support for the Arts

Beyond education and healthcare, Icahn has made contributions to the arts. He has supported numerous cultural institutions, understanding the role that art and culture play in society. His philanthropic activities in this area may not be as widely publicized, but they reflect his belief in the importance of preserving and promoting the arts for future generations.

Personal Life

Carl Icahn’s personal life has always been closely intertwined with his business ventures. Born in 1936 in New York City, Icahn grew up in a modest household, the son of two educators. His drive for success led him to Wall Street, where he built his career.

Icahn has been married twice. His first marriage was to Liba Trejbal, with whom he has two children: Brett and Michelle. Brett Icahn, who has worked as a portfolio manager for Icahn Enterprises, is being groomed to take over his father’s business empire. This succession plan highlights Carl’s desire to keep his legacy within the family. In 1999, Icahn married Gail Golden, with whom he continues to share his life.

Despite his success, Icahn maintains a relatively private personal life, staying focused on his business ventures well into his 80s. He is known to be an avid chess player, a hobby that aligns with his strategic thinking in both life and business. His love for philosophy, which he studied at Princeton, also continues to influence his worldview and decision-making process.

Commitment to Giving Away His Wealth

Though Icahn has amassed a fortune over the decades, he has made a public commitment to give away the majority of his wealth either during his lifetime or through his estate. In line with this commitment, he has continued to focus on large-scale donations, ensuring that his legacy will be defined not only by his business acumen but also by his philanthropic efforts.

Current Endeavours

Mr. Icahn remains an influential figure in the investment world, and his ability to evolve with the times is key to how Carl Icahn got rich and maintained his wealth over the years. He continues to focus on undervalued companies, advocating for shareholder rights and promoting corporate responsibility. His investments now include renewable energy and companies adopting sustainable practices.

Net Worth

As of September 2024, Carl Icahn’s net wealth is estimated at some $6 billion according to Forbes.

Carl’s wealth peaked in 2015 at an estimated $25 billion. And has seen a $10 billion decline in just one day in 2023 after Hinderburg Research report.

Lessons from Carl Icahn

Spotting Opportunities Others Miss

Icahn’s ability to see value in underperforming or undervalued companies is key to his success. This teaches us the importance of deep analysis and looking beyond the surface when assessing opportunities.

Taking Calculated Risks

Icahn often made bold moves, such as hostile takeovers and large investments in distressed assets. His success reminds us that taking calculated risks is essential for significant rewards, but only when backed by thorough research and a clear strategy.

Persistence in the Face of Challenges

Icahn faced many obstacles, including failed investments and legal challenges. His persistence through setbacks shows that success often comes to those who don’t give up easily and are willing to adapt their strategies when needed.

The Power of Influence

Icahn’s ability to push for change within companies demonstrates the power of influence. By actively engaging with company boards and management, he made a tangible impact, showing us that advocating for change can lead to substantial outcomes when executed effectively.

Learning from Failures

Icahn’s experience with TWA, where his asset-stripping strategy led to the airline’s bankruptcy, teaches that even the most successful people make mistakes. What’s important is learning from failures and adjusting your approach to avoid similar missteps in the future.

Maximising Shareholder Value

Icahn’s focus on increasing shareholder value through buybacks, dividends, and improved management teaches the importance of ensuring all stakeholders benefit from business decisions. This mindset can help align interests and improve long-term outcomes.

Evolving with the Market

His move into technology investments in companies like Apple and Netflix shows the importance of adaptability. Staying current with market trends and being open to new industries ensures continued success, even in a rapidly changing environment.

Leveraging Knowledge for Success

Icahn’s success in options trading and corporate takeovers stems from his deep knowledge of market mechanisms. This highlights the importance of continuously building expertise and leveraging that knowledge for smart decision-making.