Last Updated on September 14, 2024 by Vlad

Prajogo Pangestu’s rise to wealth is a remarkable story of business acumen and strategic investments. If you’ve ever wondered how did Prajogo Pangestu get rich, the answer lies in his ability to spot opportunities and diversify his business interests. His journey began in the timber industry, but his wealth truly exploded when he expanded into petrochemicals and renewable energy, particularly geothermal power. These sectors, combined with his astute business sense, helped him build a multi-billion-dollar empire.

So, how did Prajogo Pangestu make his money? After establishing a successful timber business in the late 1970s, Pangestu launched Barito Pacific, which went public in 1993. The public listing enabled him to raise the capital necessary to expand into other industries. One of the key milestones in how Prajogo Pangestu got rich was his acquisition of Chandra Asri Petrochemical, Indonesia’s largest petrochemical company. This strategic move, along with his early investments in geothermal energy, played a critical role in boosting his wealth.

His success continued to grow, and his ability to diversify further into property development, plantations, and renewable energy demonstrates how Prajogo Pangestu stayed ahead of market trends. These ventures are key in answering the question of how did Prajogo Pangestu get rich, as they represent a well-rounded approach to wealth building, with multiple revenue streams supporting his empire.

Key Takeaways

- Pangestu’s fortune was built through strategic investments across industries.

- His wealth was boosted significantly by investments in geothermal energy.

- Diversifying business interests played a major role in his financial success.

Early Life and Education

Prajogo Pangestu was born on May 13, 1944, in a remote part of Indonesia, on the island of Borneo. His birth name was Phang Djoen Phen, and he grew up in a modest household of Hakka origins. His father was a rubber trader, and it is likely that this early exposure to the business world gave him insights into trade and commerce at a young age.

In his early years, Pangestu worked as an angkot (shared minivan) driver, an experience that grounded him and shaped his strong work ethic. While there are limited details about his formal education, Pangestu’s practical experiences in trade and transportation became a crucial factor in his business development later in life. His humble beginnings did not deter him from pursuing larger ambitions, and his journey from a modest background to becoming Indonesia’s wealthiest man is a testament to his determination and entrepreneurial spirit.

Entry into the Business World

Prajogo Pangestu entered the business world in the late 1970s, beginning his journey in the timber industry. At that time, Indonesia’s forests were rich in timber resources, and the industry was thriving. Recognising the opportunity, Pangestu made the bold decision to start his own timber trading company in 1977. This marked the start of his entrepreneurial career.

His company, which would later become Barito Pacific, quickly gained momentum. Pangestu’s keen eye for opportunity, combined with his hard work, allowed the company to grow rapidly, expanding its market share in Indonesia’s booming timber sector. By 1993, his timber company had grown large enough to go public on the Jakarta Stock Exchange. The public listing not only marked a critical milestone for Pangestu but also provided the capital needed for future expansion into other industries.

Key to his early business success were:

- A bold decision to enter the booming timber industry in the late 1970s.

- Rapid company growth, culminating in a public listing in 1993.

- Strategic use of capital markets to fund future expansions.

Rise of Barito Pacific

Founded as a timber business, Barito Pacific soon diversified into other industries, transforming into one of Indonesia’s largest conglomerates. After going public in 1993, Pangestu leveraged the capital raised from the stock market to expand into industries such as petrochemicals, energy, and property development.

A significant turning point for Barito Pacific came with the acquisition of Chandra Asri Petrochemical, Indonesia’s largest petrochemical company. This acquisition made Barito Pacific a major player in Indonesia’s industrial landscape, further increasing Pangestu’s wealth. Additionally, Pangestu invested heavily in geothermal energy, recognising the growing demand for renewable energy in the global market.

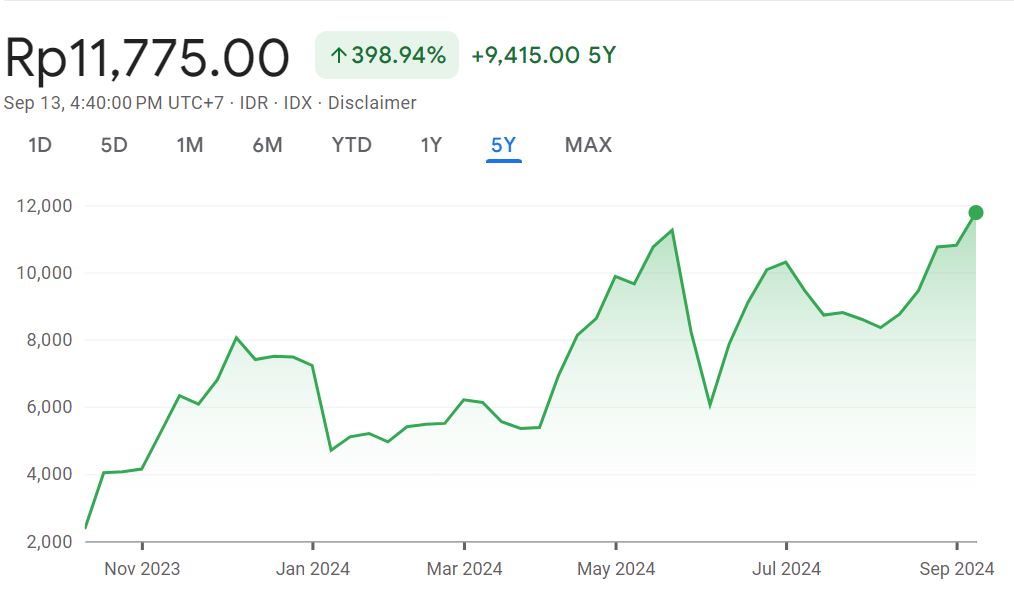

In 2023, Barito Pacific spun off its renewable energy unit, Barito Renewables, through an initial public offering. This IPO was highly successful and further boosted Pangestu’s net worth, solidifying his position as one of the wealthiest individuals in Asia.

Diversification of Business Interests

As Pangestu expanded his business empire, he strategically diversified his interests into various sectors, minimising risks and maximising profits.

Expansion into Petrochemicals

In the 1990s, Pangestu made a major move into the petrochemical industry by acquiring a stake in Chandra Asri Petrochemical, which became one of the leading producers of olefins, polyolefins, and other chemical products in Indonesia. These materials are crucial for industries such as packaging, automotive, and electronics. His investment in petrochemicals proved highly profitable and helped shield him from the volatility of the timber industry.

Venturing into Property and Plantations

Pangestu’s diversification strategy didn’t stop at petrochemicals. He also ventured into property development and plantations. He developed major housing complexes, office buildings, and shopping centres in various Indonesian cities, capitalising on the country’s growing urban population. Additionally, his investments in palm oil and rubber plantations allowed him to tap into the rising global demand for commodities, further increasing his wealth.

This broad diversification allowed Pangestu to build a resilient business empire, with revenues coming from a variety of sectors, ensuring steady growth regardless of market conditions.

Strategies for Wealth Accumulation

The way Prajogo Pangestu’s built a massive fortune was not by chance; it was the result of calculated strategies that helped him build a multi-billion dollar empire.

Strategic Partnerships and Acquisitions

Pangestu formed key business alliances with international firms, gaining access to new technologies and capital. One of his most important partnerships was with Siam Cement Group, which gave him a foothold in the petrochemical sector. He also acquired undervalued assets during economic downturns, ensuring he gained control of profitable businesses at discounted prices.

Political Connections

In addition to his business acumen, Pangestu used his political connections to navigate Indonesia’s complex regulatory environment. During the Suharto era, he benefited from policies that favoured his timber business, such as logging concessions and export licences. Even after Suharto’s regime ended, Pangestu continued to maintain strong ties with the political elite, adapting to different administrations and ensuring that his businesses remained protected.

Adaptation to Market Changes

Pangestu was quick to adapt to changing market conditions. As Indonesia’s timber resources dwindled, he shifted his focus to petrochemicals and later to renewable energy, particularly geothermal power. This ability to pivot his business interests kept his company relevant and allowed him to take advantage of new opportunities before competitors did.

Timeline of Key Milestones

Key milestones that explain just how did Prajogo Pangestu get rich.

- 1977: Founding of his timber business.

- 1993: Public listing of Barito Pacific.

- 1999: Acquisition of Chandra Asri Petrochemical.

- 2023: IPO of Barito Renewables.

Prajogo Pangestu’s Net Worth Today

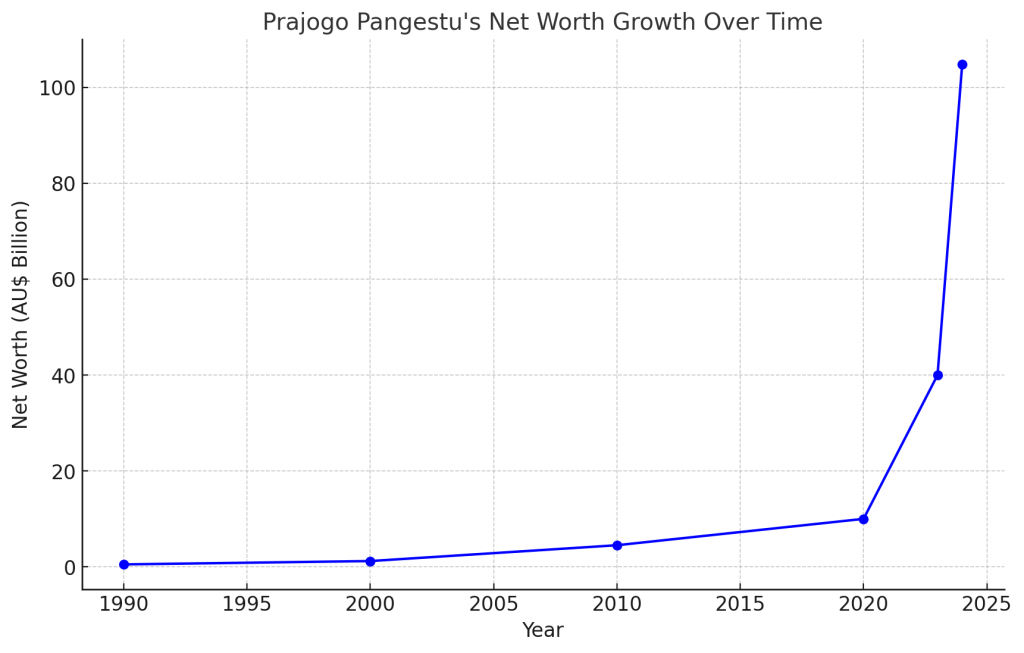

As of September 2024, Prajogo Pangestu’s net worth is estimated at $75.8 billion, making him the richest person in Indonesia, and one of the wealthiest individuals globally. His wealth primarily stems from his investments in petrochemicals and geothermal energy, industries in which his company, Barito Pacific, has substantial holdings.

A significant factor behind Pangestu’s wealth growth has been his early investments in geothermal energy, a sector that has surged in recent years due to increasing global demand for renewable energy. As of now, Pangestu ranks among the top 25 wealthiest individuals in the world, and while market fluctuations may affect his ranking, his diverse portfolio ensures that his wealth remains stable.

Surge in Wealth

Prajogo Pangestu’s net worth experienced a significant surge in 2023 and 2024 primarily due to two key factors:

1. Geothermal Energy Investments

One of the biggest drivers behind Pangestu’s wealth explosion is his investment in geothermal energy. Indonesia has some of the world’s richest geothermal resources, and Pangestu, through Barito Pacific, capitalised on this by investing heavily in renewable energy projects.

In 2023, Barito Renewables, a subsidiary focusing on renewable energy, launched its initial public offering (IPO). The IPO was highly successful, and the market’s strong interest in renewable energy stocks boosted Pangestu’s net worth significantly. As the world shifts towards greener energy solutions, his timely investments in geothermal energy paid off tremendously, elevating him to a new level of wealth.

2. Chandra Asri Petrochemical Expansion

Another major contributor to his wealth surge has been the growth of Chandra Asri Petrochemical, Indonesia’s largest petrochemical company, which Pangestu controls. The company expanded its production capabilities and market reach, making it a dominant player in the Southeast Asian market. Global demand for petrochemical products—used in industries such as packaging, automotive, and electronics—has been strong, contributing to Barito Pacific’s revenue growth.

Global Impact and Influence

Though Prajogo Pangestu’s business empire is based in Indonesia, its influence extends far beyond Southeast Asia. Chandra Asri Petrochemical, a subsidiary of Barito Pacific, plays a crucial role in the global petrochemical supply chain. As Indonesia’s largest petrochemical company, it produces essential materials like olefins and polyolefins, which are used in industries such as packaging, automotive, and electronics worldwide.

Chandra Asri’s products are exported to various countries, contributing to Indonesia’s trade balance and positioning Pangestu as a key player in global industrial production. In particular, olefins are the backbone of modern manufacturing, used in products like plastics, making Pangestu’s company vital in the global market.

His foray into geothermal energy has also given Pangestu a significant foothold in the rapidly growing renewable energy sector. Indonesia is one of the world’s largest producers of geothermal energy, and Barito Pacific’s investments in this area not only help meet domestic energy needs but also contribute to the global transition to sustainable energy. Pangestu’s vision aligns with international goals to reduce carbon emissions and combat climate change, making him a notable figure in the global energy transformation.

Philanthropy and Social Contributions

While Pangestu’s business achievements are well-known, his philanthropic efforts, though quieter, have made a significant impact in Indonesia. He has donated substantial amounts to education and healthcare, areas that he sees as critical to the country’s development.

One of his notable contributions is the funding of scholarships for underprivileged students through Barito Pacific’s educational programs. These scholarships aim to give talented young Indonesians from rural areas the opportunity to attend higher education institutions, which might otherwise have been beyond their reach.

In healthcare, Pangestu has contributed to the construction and modernization of hospitals, particularly in underserved regions of Indonesia. He has also supported medical research initiatives, aiming to improve healthcare services and outcomes for Indonesians.

Additionally, through his company’s corporate social responsibility (CSR) programs, Pangestu has funded infrastructure projects in rural communities, providing clean water, education facilities, and healthcare services to improve the quality of life in these areas.

His philanthropic legacy is an important part of how he gives back to the country that helped him build his fortune, and it underscores his commitment to Indonesia’s social and economic progress.

Family Legacy and Succession Plans

As Pangestu ages, questions about the future of his empire naturally arise. While much of his fortune and success are tied to his personal leadership, his children are increasingly taking on vital roles within Barito Pacific and its subsidiaries. Pangestu has been deliberate in keeping the business within the family, ensuring that his legacy will endure through the next generation.

His son, Adi Nugroho Pangestu, has taken on leadership roles in several of Pangestu’s companies, particularly in Barito Pacific. He is seen as the likely successor to continue steering the conglomerate after Pangestu retires or steps back. Adi has been actively involved in the company’s renewable energy initiatives, showcasing his commitment to expanding Barito Pacific’s green energy footprint.

There is little public information on Pangestu’s detailed succession plan, but with his children deeply involved in the business, it’s clear that the family dynasty will continue to play a dominant role in Indonesia’s business world. This focus on maintaining family control also provides stability and ensures that the company’s core values and long-term strategies remain consistent.

Quotes or Statements

Prajogo Pangestu is a reserved figure, often keeping a low profile in the media. However, in the few instances where he has shared his thoughts on business, his words reflect his practical and forward-thinking approach.

In one rare interview, Pangestu remarked:

“Success in business isn’t about taking unnecessary risks but seeing opportunities before others do. You don’t just wait for things to happen. You make them happen.”

This quote encapsulates his strategy of diversification and his ability to anticipate shifts in the market, such as his early investment in renewable energy long before it became a global trend.

Industry insiders have also commented on Pangestu’s quiet yet impactful leadership. One prominent Indonesian business figure described him as:

“A visionary leader who may not be in the headlines often, but his moves in the business world speak louder than words. His ability to see potential in industries like petrochemicals and geothermal energy has reshaped Indonesia’s industrial landscape.”

These insights reveal that while Pangestu may avoid the spotlight, his influence in Indonesia and the global business community is undeniable.

Comparisons with Other Billionaires

Pangestu’s rise to wealth can be compared to other Indonesian billionaires like Low Tuck Kwong and the Hartono brothers. While the Hartono brothers amassed their fortune in the tobacco industry and diversified into banking, and Low Tuck Kwong earned his wealth through coal mining, Pangestu’s strategy was rooted in timber before pivoting to petrochemicals and renewables.

Unlike many other billionaires in Indonesia, Pangestu’s diversification into geothermal energy sets him apart as a forward-thinker, positioning him as a key player in the global energy transition. His business moves are more aligned with global sustainability trends compared to other billionaires whose fortunes remain tied to industries like coal or tobacco.

On the global stage, Pangestu’s strategic diversification mirrors the paths of other notable billionaires like Warren Buffett, who also expanded his wealth through strategic acquisitions across multiple industries, and Elon Musk, whose investments in renewable energy through Tesla resonate with Pangestu’s geothermal ventures. Both figures have built empires by positioning themselves ahead of market trends, similar to Pangestu’s ability to enter renewable energy at the right time.

Vision for the Future

Looking ahead, Pangestu’s business interests are likely to continue expanding, particularly in the area of renewable energy. Indonesia’s abundant geothermal resources make it one of the top producers of geothermal power in the world, and Barito Pacific is well-positioned to capitalise on this opportunity.

Beyond geothermal energy, it’s possible that Pangestu will explore other green technologies, such as solar or wind energy, as part of his long-term strategy to align with global energy shifts. His company is also exploring carbon capture and storage technologies, which could play a crucial role in reducing Indonesia’s carbon emissions and making Barito Pacific a leader in sustainable energy solutions.

As the world continues to move towards reducing carbon emissions, Pangestu’s focus on renewables ensures that his business empire will remain relevant and continue to grow in the future. His ability to pivot toward the green economy could define his next phase of wealth accumulation.

In what industries could Pangestu invest next?

As a forward-thinking businessman, Prajogo Pangestu has already diversified into various industries like timber, petrochemicals, and renewable energy. Given his track record of entering high-growth sectors, here are some industries he might consider investing in next:

Electric Vehicles (EVs) and Battery Manufacturing

With the global shift towards electric vehicles, the EV industry is rapidly growing. Indonesia is rich in nickel, a key material in lithium-ion batteries, which power EVs. Pangestu could invest in EV manufacturing or battery production to tap into this expanding market. As the demand for clean energy transportation rises, building battery plants or partnering with EV companies could be a lucrative move.

Artificial Intelligence (AI) and Automation

Artificial Intelligence and automation are transforming industries worldwide. By investing in AI technology, Pangestu could help modernise sectors like manufacturing, energy, and logistics. AI-powered automation is revolutionising operational efficiency, and it aligns well with his interest in emerging technologies. Additionally, investing in AI startups or robotics could position him as a leader in tech-driven solutions across industries.

Green Building and Sustainable Construction

As global interest in sustainable construction grows, the green building industry offers significant investment opportunities. With urbanisation increasing in Indonesia and other parts of Asia, eco-friendly construction materials and energy-efficient buildings are in demand. Pangestu could invest in companies that specialise in sustainable construction technologies or green architecture, aligning his business with environmental goals.

Biotechnology and Healthcare Innovation

Biotechnology is another promising sector for future investment. The healthcare industry is increasingly relying on biotech innovations, such as gene therapies, personalised medicine, and biopharmaceuticals. Given Pangestu’s philanthropic interest in healthcare, he could invest in biotech startups focused on developing new treatments, vaccines, or medical technologies. This would not only diversify his portfolio but also align with his commitment to improving healthcare in Indonesia.

Agriculture Technology (AgriTech)

Agriculture technology (AgriTech) is revolutionising farming through innovations like precision agriculture, vertical farming, and genetic crop engineering. As global food demand rises and resources become more strained, AgriTech presents an opportunity for sustainable farming solutions. Investing in smart farming technologies could allow Pangestu to tap into a critical industry while also addressing food security challenges.

Fintech and Digital Banking

The fintech industry, particularly in Southeast Asia, is booming, with digital banking and online payment systems transforming how people manage finances. Pangestu could invest in digital banking platforms, blockchain technology, or fintech startups that offer services like mobile payments, lending platforms, and cryptocurrency. This would enable him to benefit from the region’s rapidly digitising economy.

Carbon Credits and Emissions Trading

As the world increasingly prioritises sustainability, the carbon credits and emissions trading market is growing. Governments and corporations are looking for ways to offset their carbon footprints. Pangestu could invest in companies that trade carbon credits or support carbon capture technologies. These investments would align with his interest in green energy and help his businesses maintain a leadership position in the global fight against climate change.

Data Centres and Cloud Infrastructure

As more companies move to the cloud and the demand for data storage and cloud infrastructure grows, investing in data centres could be a strategic move for Pangestu. Data centres are essential for supporting cloud computing, artificial intelligence, and big data analytics. By investing in this sector, Pangestu could play a role in building the digital backbone for the region’s growing tech economy.

Renewable Hydrogen

While he’s already involved in geothermal energy, Pangestu might also explore renewable hydrogen. Green hydrogen, produced using renewable energy sources, is gaining attention as a potential game-changer in industries like transportation and heavy manufacturing. Pangestu could invest in the production or infrastructure needed for hydrogen energy, which is poised to play a larger role in the global energy market.

Waste Management and Recycling

With growing concerns about environmental pollution and sustainability, the waste management and recycling industries are becoming crucial. Pangestu could invest in waste-to-energy technologies or recycling facilities to manage waste sustainably and create energy from waste products. As urbanisation increases, effective waste management solutions are becoming more critical, and investing in this space could position him as a leader in environmental sustainability.

Lessons from Pajogo Pangestu

By studying just how Pajogo Pangestu got rich, we can learn valuable lessons about resilience, investing in future trends, and the importance of a long-term vision in business

The Power of Diversification

One of the most important lessons from Prajogo Pangestu’s success is the power of diversification. Starting in the timber industry, he expanded into petrochemicals, energy, property development, and plantations. By spreading his investments across different industries, Pangestu was able to reduce risks and maximise growth. This approach shows the value of not relying on a single income stream or sector but rather looking for opportunities across various markets.

Key Takeaway: Don’t put all your eggs in one basket. Diversifying your investments or business interests can protect against market fluctuations and open new opportunities for growth.

Identifying Market Trends Early

Pangestu had a knack for spotting emerging trends before they became mainstream. His early investment in geothermal energy is a prime example of how recognizing the potential in renewable energy positioned him for success. By investing in a sector that was poised to grow, Pangestu capitalised on the global shift toward sustainability and green energy, ensuring his wealth continued to rise.

Key Takeaway: Stay informed about global trends and emerging industries. Being an early mover in a high-growth sector can provide a significant competitive advantage.

Resilience in the Face of Challenges

Pangestu’s business journey wasn’t without its setbacks. The Asian Financial Crisis and environmental challenges in Indonesia’s forestry industry could have severely impacted his fortune. However, Pangestu adapted by shifting his focus to other industries, such as petrochemicals and renewable energy, showing that resilience and adaptability are crucial in overcoming business challenges.

Key Takeaway: Adaptability and resilience are essential in business. When faced with obstacles, successful entrepreneurs find ways to pivot and turn challenges into new opportunities.

Strategic Use of Public Markets

Pangestu’s decision to take Barito Pacific public in 1993 was a turning point in his career. The public listing gave him access to significant capital, which he used to expand into petrochemicals and energy. This move highlights the importance of timing and strategic financing in business growth.

Key Takeaway: Strategic financial decisions, such as going public or raising capital at the right time, can accelerate business growth and open new avenues for expansion.

Importance of Long-Term Vision

Pangestu’s focus on long-term industries like renewable energy shows his commitment to sustainability and future growth. His investments in geothermal power, for example, are not just about short-term gains but align with long-term global trends in energy consumption and climate action.

Key Takeaway: Building wealth requires a long-term vision. Look beyond immediate gains and focus on investments or industries that will continue to thrive in the future.

Leveraging Political and Business Networks

Pangestu was able to navigate the complexities of Indonesia’s business and political landscape, leveraging relationships to gain access to valuable opportunities like logging concessions and export licences. He maintained these connections through changing political regimes, ensuring his businesses remained competitive.

Key Takeaway: Building strong networks in business and politics can provide strategic advantages. Use your relationships to open doors and secure opportunities that can fuel growth.

Giving Back to Society

Through his philanthropic efforts in education, healthcare, and community development, Pangestu has shown that success is not just about accumulating wealth but also about making a positive impact on society. His scholarship programs and contributions to hospitals demonstrate his commitment to improving lives in Indonesia.

Key Takeaway: True success includes giving back to society. Philanthropy and corporate social responsibility not only improve your community but also enhance your legacy and reputation.